In the growing world of finance and leasing it can a great idea to get that beautiful watch on finance so you can pay it off in more affordable instalments, especially when you’re looking at a luxury or high end time piece with a large price tag.

Many other markets have seen a huge increase over recent years with applications of finance from previous years with Consumerreports stating that “A record 84.5 percent of shoppers who acquired a new car last quarter used financing, either a loan or a lease.” This huge increase has come about from the amount of businesses readily accepting finance and the amount of customers looking to purchase through these finance options due to being able to spread out the payments, sometimes at a 0% APR meaning no additional cost to them for spreading it out.

Here at First Class Watches we accept finance for our watches and jewellery however like most retailers we do have a few requirements that you would need to meet to qualify for finance with one of the two finance lenders that we use.

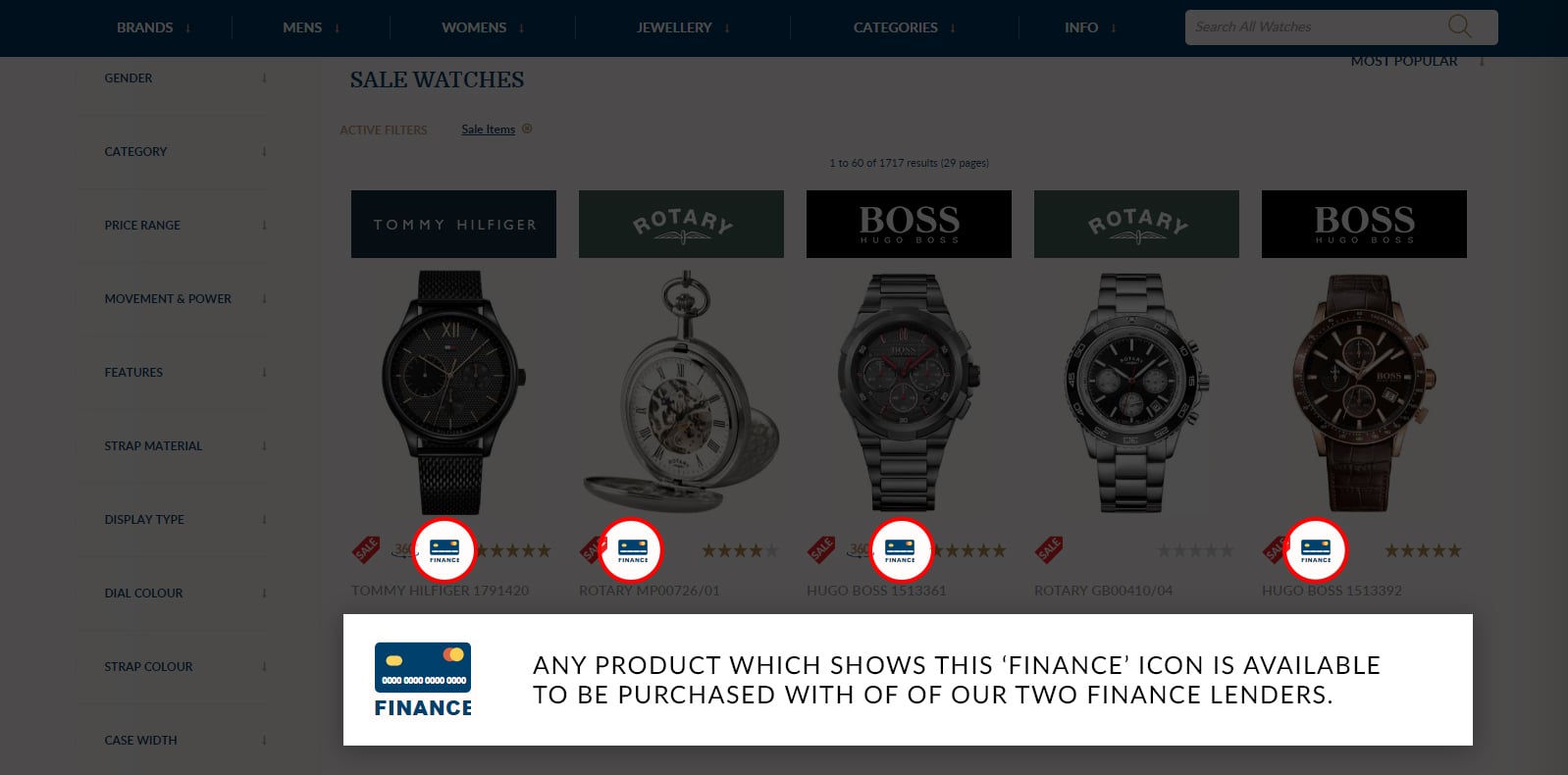

Each of our products that is available to purchase with a finance application will have two indications that it is an option:

- There will be a small credit card icon with the word ‘FINANCE’ written underneath it, this is displayed on the product category list page for any products where available. If there is not a credit card finance option icon it means that this product is not available for purchase without finance.

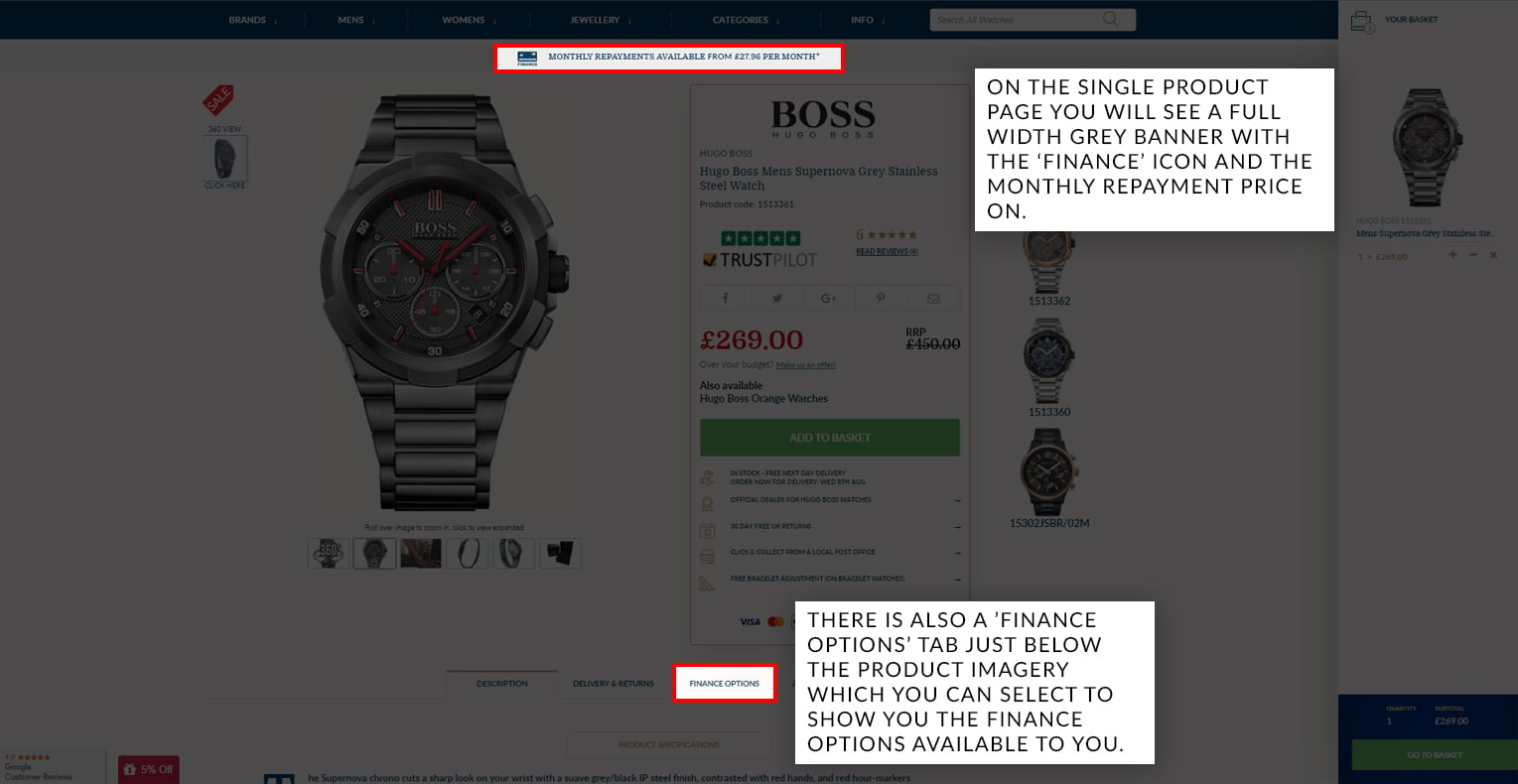

- On the single product page there is a grey bar which runs along the top of the page for all products which have finance available. The bar also states the cost of the monthly instalments on them too which our customers found useful. There is also a ‘Finance Options’ tab which you can select just below the product imagery which has a more detailed breakdown of the costs and duration of the finance which you can customise to meet your needs.

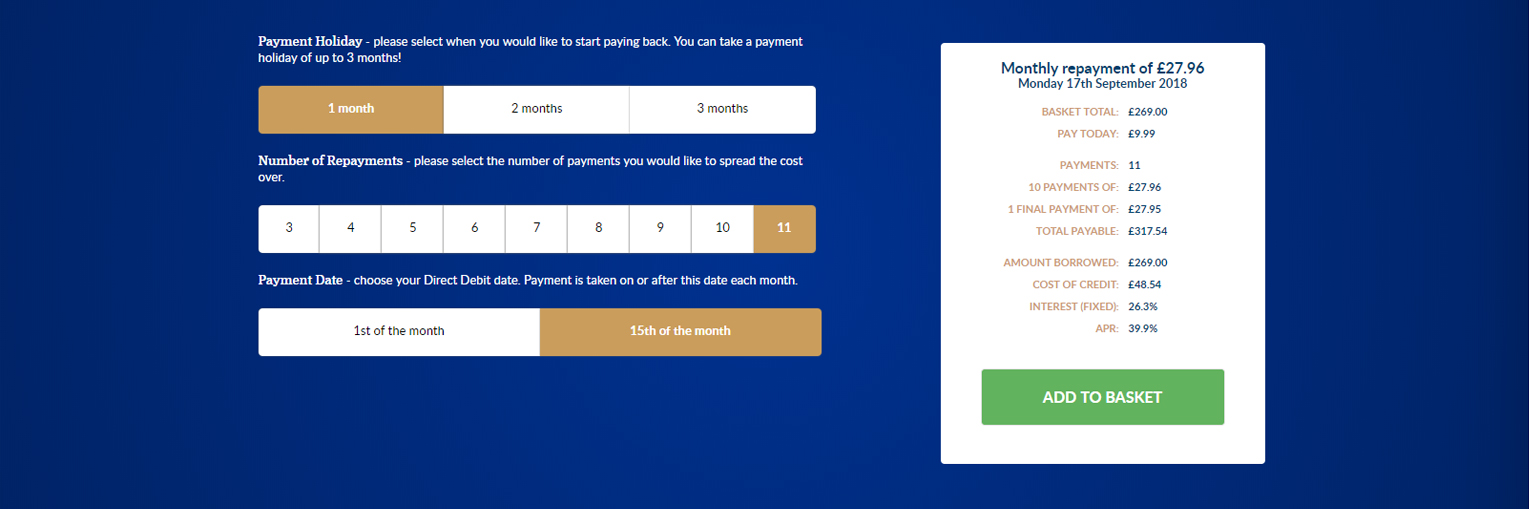

Once you’ve clicked the finance tab and it loads up you will see the finance customiser where you can adjust the payment holiday, number of repayments and payment date. You can then see on the right hand side a list of the cost of your monthly repayments and the interest you will be paying if any.

Would I be accepted for finance?

Like with all finance applications the lender will look at your credit score and decide if they want to offer you the money with the terms you have searched for or select. They will usually come back with an instant response however if your credit history has a few bumps here and there they may need to get an adviser to manually look over your application before they are able to make a decision.

Once an adviser has looked at it they may choose to accept your application with a higher interest rate, this all depends on your credit score and history.

You can only apply for finance at First Class Watches as long as you meet the following requirements:

- You are 18 or over, and employed at least 16 hours per week

- You have a good credit history with no late payments, debt relief orders, CCJs, IVAs or bankruptcies

- You are a permanent UK resident and able to supply a UK address history for the last 3 years

- You are not a student (unless employed at least 16 hours per week) or unemployed single house person

Please note that despite rumours around retired or older age persons we actively welcome applications from these individuals as long as they are in receipt of a private or company pension. This applies for applicants aged 50 or over at date of application.

When filling out the application form online or in store please please please ensure your application is as accurate as possible as this helps to maximise your chances of the application being accepted. A decision will then be made based on credit history available from a variety of sources such as the credit bureaus and public registers such as the electoral roll. It is also very important to state that meeting the above criteria does not guarantee finance acceptance however hitting all of the requirements would be an indication of a good applicant.

How do I make a credit application?

So you’ve had a look around the site and found a stunning product that you have your eye set on, you’ve done some research into the finance requirements and meet the fields required and you’re ready to start the application, but where do you go from here?

Well the first step in starting your credit application is to simply add the product you wish to buy to your basket. Once you’ve done this you need to navigate to the shopping basket (you can do this from the basket icon at the top of the page or from the right sidebar that appears on larger screens).

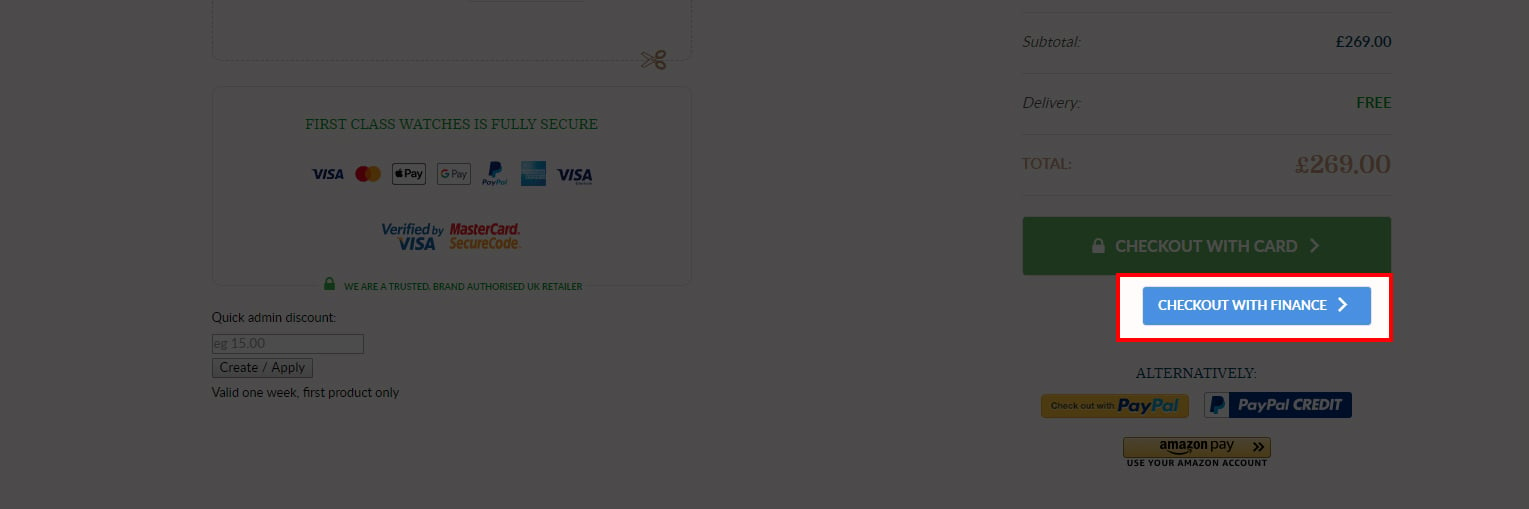

When you’re on the basket page click “Checkout with finance” on the checkout options (see screenshot below)

This will take you through to the finance checkout page where you can adjust the payment holiday, number of repayments and payment date just like the customiser on the product page. Please note that any customisation you make here will change the terms of your finance application so be careful and double check that these are correct as you cannot change them once the application has been submitted.

Once you are happy with these terms click “Apply Now” and you will be taken to the finance lenders application process, from here you will be asked to input your personal details such as name, address, residency history and bank details.

Please note that you will be asked to make either a service charge of £9.99 (taken while applying with afforditNOW) or your deposit payment (Close Brothers Retail Finance) using credit or debit card whilst applying for finance. This is fully refunded is the application is not successful.

What happens after I am approved?

Upon hearing the good news that your application has been successful the finance lender will send the application order over to ourselves and we will send you your order confirmation.

The times for the review process can vary on an order by order basis as everyone’s credit score is different and someone will get an instant decision whereas others may require manual approval.

After we have sent your order confirmation as long as the item is in stock then we will ship your order in our next collection, tracking information is emailed over to you as soon as the delivery courier collects the package and you can check online at any time for live updates regarding the postage.

My application was declined, why?

Unfortunately as we use a third party finance lender and the finance is not offered by us directly we are not given a reason by the lender as to why it has been declined so we are unable to comment on individual applications.

If you believe your application should have been accepted please note that sometimes applications can be declined due to incorrect information being given. Please ensure your address history is entered correctly and is the same as registered with your bank and the electoral roll (if applicable). If you have paid a deposit this will be refunded automatically within 3-5 working days.

How are payments made?

Your initial deposit is payable by credit or debit card. Once your order has been shipped we will notify the credit lender. Payments are then taken automatically by direct debit for peace of mind either after your payment holiday when using afforditNOW or after approximately 30 days with Close Brothers Retail Finance. For more information please see your credit agreement.